Cryptocurrencies and the future

Cryptocurrencies came into existence in January 2009 as a side product of Satoshi Nakamoto, the unknown architect of Bitcoin, the first cryptocurrency invented as “A Peer-to-Peer Electronic Cash System.“ The aim was to invent digital cash as a way to build a decentralised digital cash system. Yet in 2018, the majority of people including bankers, financial consultants and developers show very limited knowledge and often fail to even understand the basic concepts.

What is the fuss all about?

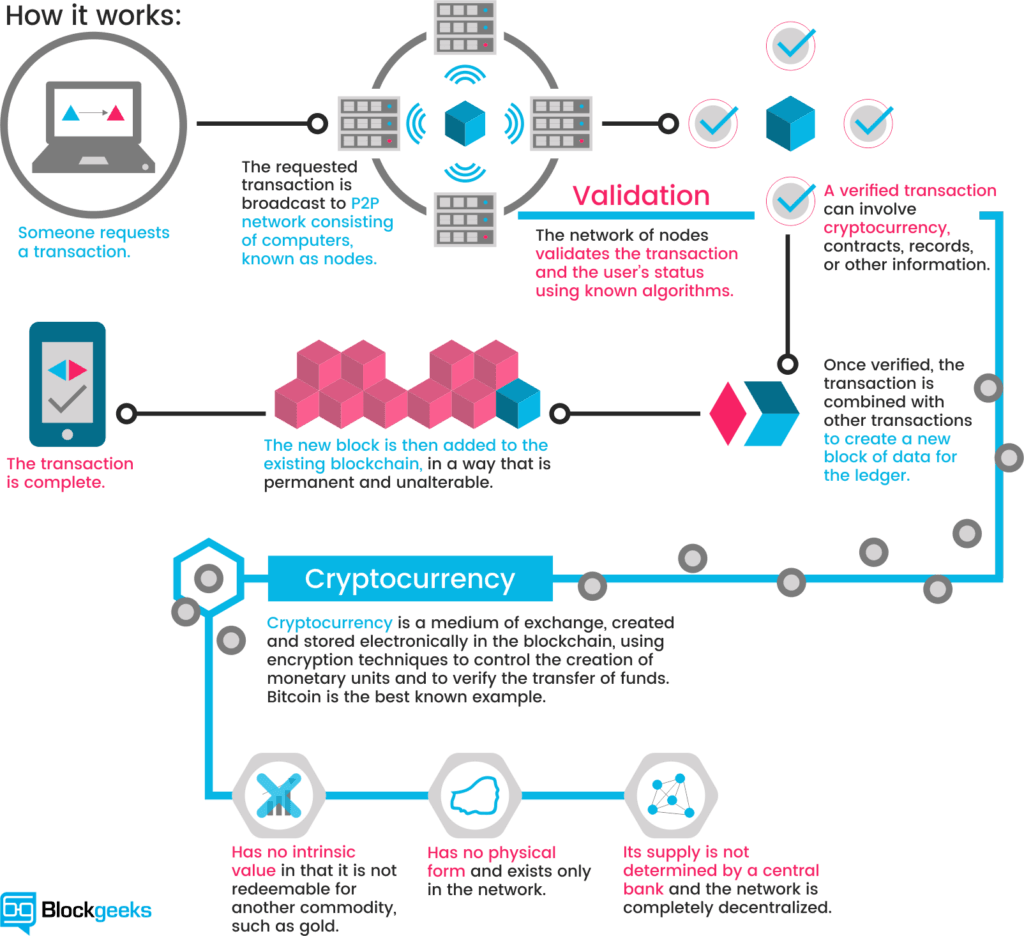

To comprehend digital cash, one needs a payment network with accounts, balances, and transactions. Since transactions occur in a decentralised network, there is no need for a server but every peer in the network has a list of all transactions that can be checked and validated using absolute consensus. A cryptocurrency like Bitcoin consists of a network of peers with every peer having a record of the complete history of all transactions and thus of the balance of every account. A transaction is a file that says, “Person1 gives X Bitcoin to Person2“ and is signed by Person1‘s private key which is then broadcasted in the network, sent from one peer to every other peer in the network for confirmation. When the transaction is confirmed by all the peers, it becomes part of an immutable record of historical transactions of the blockchain. Miners in turn get remunerated with a token of the cryptocurrency mined, for example with Bitcoins. Miners need to invest some work of their computers to qualify for this task by finding a hash that connects the new block with the previous block, which is called the Proof-of-Work. In Bitcoin, it is based on the SHA 256 Hash algorithm.

Transactions

Since cryptocurrencies are entries that ensure the consensus-keeping process is secured by strong cryptography, the element of human error or fraud is bypassed since it is not secured by people or by trust, but by mathematics. Every transaction made on the network is:

- Irrefutable: Once confirmed, a transaction can not be reversed.

- Pseudo anonymous:Every transaction is done using a digital address (a random chain of around 30 characters) but does not contain the person’s name, physical address, or email. However,a person’s identity can still be tracked down using the public address info and IPs.

- Fast and secure: Transactions are created almost immediately in the network and are confirmed in a couple of minutes using a global network of computers (miners) located in different places around the world. Cryptocurrency funds are locked in a public key cryptography system that enables only the owner of the private key to send funds. Strong cryptography makes it impossible to steal funds, giving the owner the peace of mind that cannot be guaranteed by financial institutions today.

- Availability: Cryptocurrencies can be used by downloading a digital wallet, available for free to any person, thus enabling users to transact safely. After installed, users can receive and send Bitcoins or other cryptocurrencies without requiring the permission.

The future of Cryptocurrencies

The future of a cryptocurrencies as a currency, as opposed to a speculative asset, depends on cryptocurrency developers thinking of their technology as a “transaction medium and acting accordingly.” All over the world, many are buying cryptocurrencies to protect themselves against the devaluation of their national currency. Banks and governments are concerned that cryptocurrencies have the potential to draw their control away and change the world. One can either observe or become a part of this revolution.